This 1 High-Flying Stock Is Poised for 50% Upside as Tariffs Roil the Market

Carvana (CVNA) stock, once a high-flyer in the auto space, has seen its share price take a sharp dive, reflecting both company-specific challenges and broader industry headwinds. The online marketplace for used cars reported a sequential decline in revenue per retail unit sold in the fourth quarter. The figure dropped to $22,312 from $23,405 in the prior quarter.

Also, its profit per vehicle took a hit. Carvana’s adjusted retail gross profit per unit (GPU) fell to $3,331 from $3,617 in Q3 2024, due largely to increased depreciation and tightening spreads in the used car market. These developments weighed heavily on investor sentiment.

Tariffs Could Shift the Market in Carvana’s Favor

The recent policy shifts from the U.S. government, particularly the introduction of aggressive tariffs, could dramatically alter the market dynamics in favor of used cars and support CVNA’s growth. Tthe White House has imposed a 25% tariff on vehicle imports. Additional tariffs on select auto parts are expected to follow.

While these measures are intended to support domestic manufacturing, their short-term impact is likely to be disruptive.

Higher import costs mean higher prices for new vehicles, which could dampen consumer demand. Automakers like Ford (F) and General Motors (GM) have already seen their stock prices fall in response to these developments, as concerns over international demand and retaliatory tariffs loom large.

Interestingly, Carvana has fared even worse in the market’s immediate reaction. The stock has dropped more than 22% over the past five trading days and is currently down about 40% from its 52-week high. Yet, despite this steep decline, there’s growing reason to believe that the recent developments could be setting the stage for a recovery in Carvana stock.

Why Used Car Demand Could Surge

As new car prices rise due to tariffs and supply chain complications, consumers may increasingly turn to the used vehicle market. That’s where Carvana thrives. The company’s online marketplace provides buyers with a wide selection of pre-owned vehicles, financing solutions, and trade-in services. In this shifting landscape, Carvana stands to benefit significantly from renewed interest in used cars.

Tariffs are expected to reduce discounting in the new vehicle market, and as demand for used cars rises, so too could prices. This trend would directly support Carvana’s gross profit per unit (GPU), especially on vehicles already in its inventory. This margin improvement could be a key driver of a company’s share price rebound.

Carvana’s revenue stream is heavily weighted toward retail vehicle sales, but its business model also includes complementary products like financing, warranties, and trade-in services. As demand strengthens, these additional revenue streams should see a corresponding uptick. Management has also been focused on expanding the company’s market reach by entering new regions and deepening its presence in existing ones. These growth efforts, paired with a strategy to broaden its vehicle selection, will likely support higher sales volumes.

The Bottom Line

Looking ahead, Carvana is projecting solid gains in retail units sold and adjusted EBITDA for the full year 2025. Operationally, Carvana also focuses on controlling costs, which will cushion its bottom line. As the company grows, it should achieve better economies of scale, further enhancing profitability. From a financial health standpoint, Carvana is progressing in deleveraging and bolstering its balance sheet.

Of course, risks remain. New and used vehicle purchases are highly discretionary and closely tied to broader economic conditions. A potential economic slowdown triggered by tariffs could impact consumer confidence and spending power. Carvana’s recovery could be delayed or derailed if fears of a downturn materialize.

That said, for long-term investors, the recent pullback presents a solid buying opportunity. The company is well-positioned to benefit from structural changes in the auto industry, especially as consumers gravitate toward the used car market. Carvana aims to capture more market share over time with a focus on inventory optimization, AI-driven efficiencies, and operational scaling.

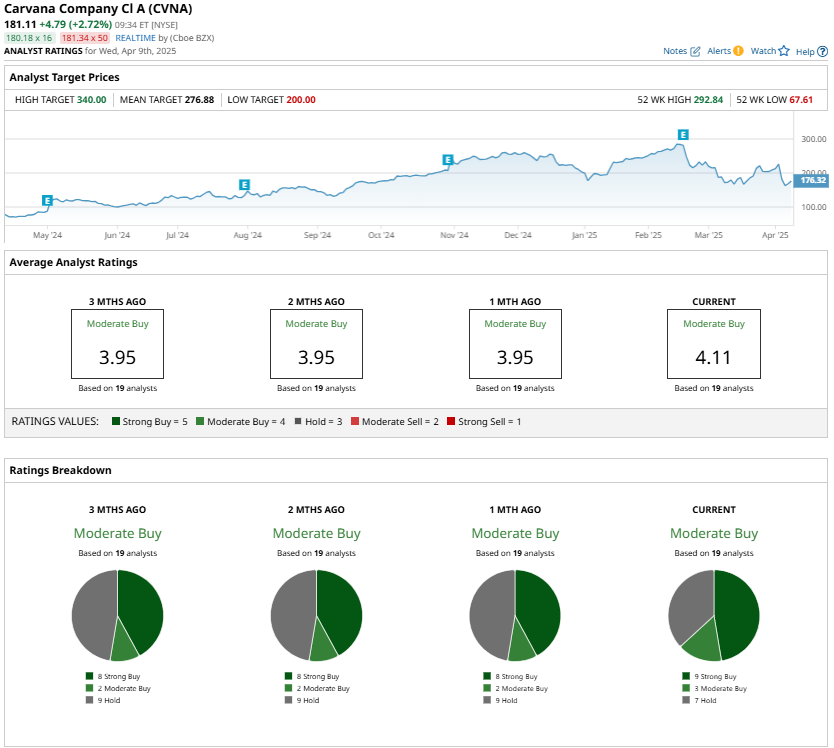

Wall Street analysts currently have a “Moderate Buy” consensus on CVNA stock, with an average price target of $276.88, which implies 55% upside from current levels.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.